A smarter, transparent way to manage your pensions and investments

Built for UK residents and global clients who want modern, flexible and secure financial solutions.

Our Products

At the heart of Invinitive is a suite of flexible, tax-efficient products designed around real people, families, expats, professionals, and long-term investors.

General Investment Account

A straightforward and versatile general investment account that allows you to build and manage a portfolio without the restrictions of pension or ISA limits. Ideal for both UK and overseas clients seeking a flexible, modern and cost-effective way to invest.

Personal Pension

A tax-efficient investment account for UK residents, offering the same digital platform experience, investment choice and ease of use as our SIPP and GIA. Designed to support long-term saving and wealth building with clear charges and full online control.

Stocks & Shares ISA

A flexible UK-registered Self-Invested Personal Pension designed to consolidate and manage your retirement savings in one place. It offers broad investment choice, multi-currency options and full online access for both UK residents and international clients.

Built Around You — Wherever You Live

UK Residents

Looking for a modern, low-cost platform that provides clear reporting, easy access and a full choice of investments across ISA, GIA and SIPP.

Expats & International Investors

Needing a secure UK-regulated home for their pension or investment assets, with the ability to access accounts, trade, and hold multiple currencies from anywhere in the world.

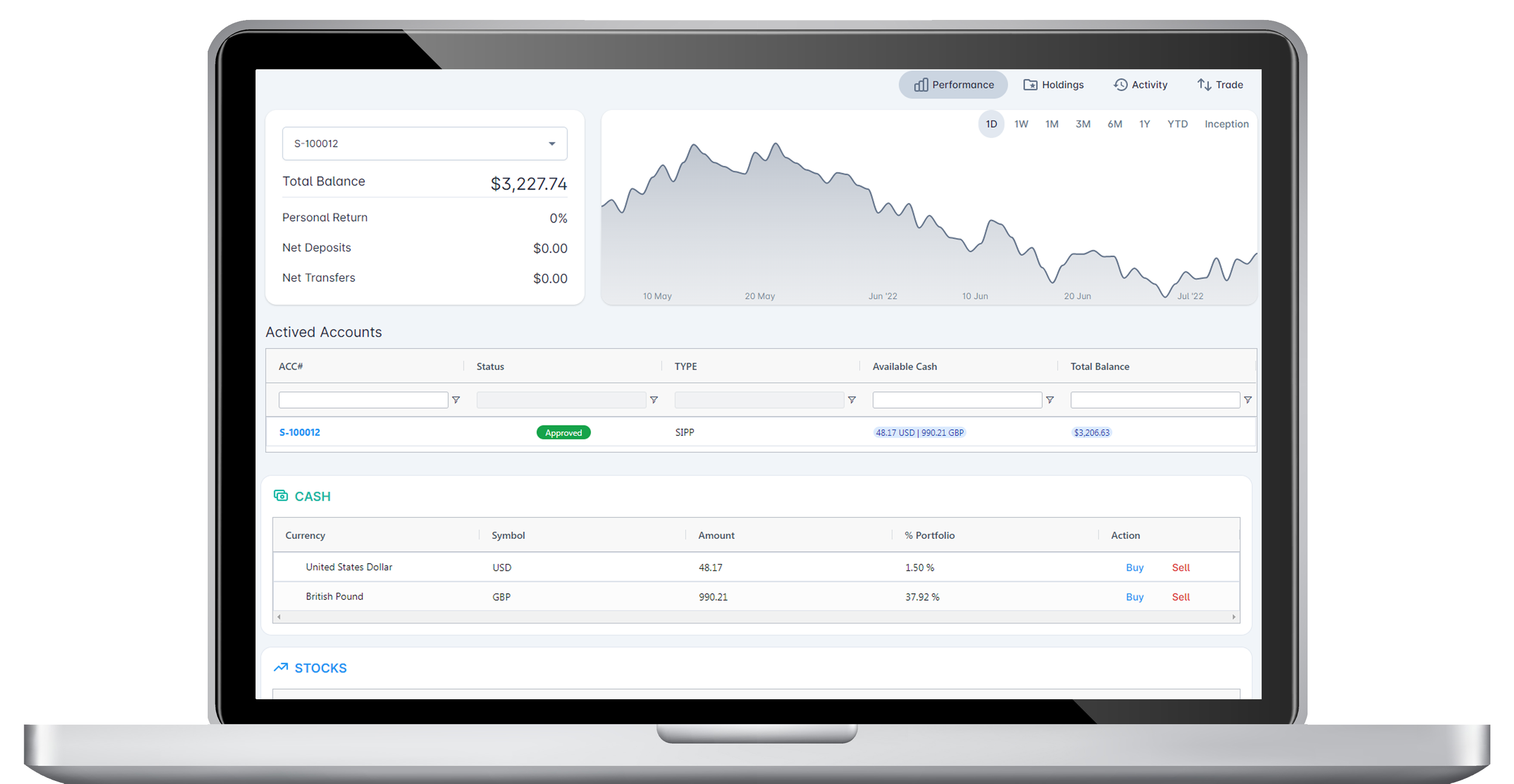

Our Digital Platform

Our platform brings together everything clients and advisers need:

Paperless onboarding

Real-time trading and live market pricing

Broad investment choice across global markets with Direct Market Access to the UK, US and EU

Multi-currency capabilities for international clients

Simple reporting and intuitive dashboards

Clear, transparent fees — no hidden charges or opaque spreads

Technology should make things easier and that’s exactly what our platform is built to do. Whether you manage your own portfolio or work with a regulated adviser, Invinitive gives you a fast, reliable and modern way to stay in control.

Have an existing pension, ISA or investment account? Transfer them over to Invinitive.

The Invinitive Investment Account is a flexible, internationally accessible investment account that allows UK expats and global investors to manage and grow their wealth across multiple markets, currencies, and asset classes without the restrictions of a traditional pension wrapper.

Why Choose Invinitive

Invinitive was founded to provide a safe, well-governed and transparent home for long-term savings. We are independently owned, FCA-regulated and committed to running a clean, high-quality book of business without unnecessary complexity.

We believe in:

Straightforward pricing

Strong governance

Sensible investment choice

Digital efficiency

A platform that serves both UK and overseas clients responsibly

Our philosophy is simple: grow steadily, protect clients, and deliver a platform that people trust.

Contact Us

Conventional

📞 Freephone in the UK:

0800 048 8485

📞 From Abroad:

+44 330 818 0845

📧 Email:

info@invinitive.co.uk

Live Chat

Please use the live chat button located at the bottom right hand corner of this webpage.

This live chat is answered by real people and not Bots or AI driven responses.

Our friendly and helpful team are on call throughout the day to assist you where needed.