Fraudsters are after your pension, do not let them have it

Be ScamSmart

Only 2 in 5 people think they know how to spot a

fraudulent investment opportunity!

The FCA conducted a YouGov poll of 1,000 people over 55. Here is what they found…

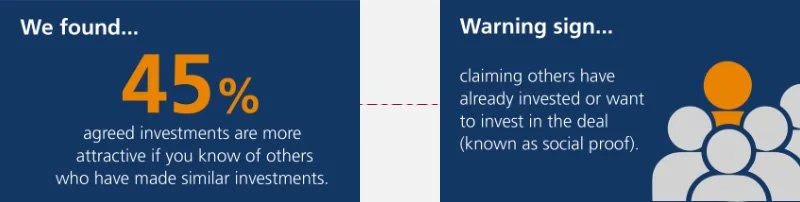

Scammers can come across as being professional, articulate and financially knowledgeable, they may have credible looking websites, a plethora of testimonials and materials that might be hard to distinguish from the real thing.

Scammers tend to design attractive offers to try to persuade you in transferring your pension savings to them or to even release funds from it to put into a standalone investment policy. The proceeds of either can then be invested in unusual and high-risk investments like overseas property, renewable energy bonds, forestry, storage units, or simply stolen outright.

Genuinely remember – if it seems to good to be true.. go with your gut!

5 Things To Look Out For

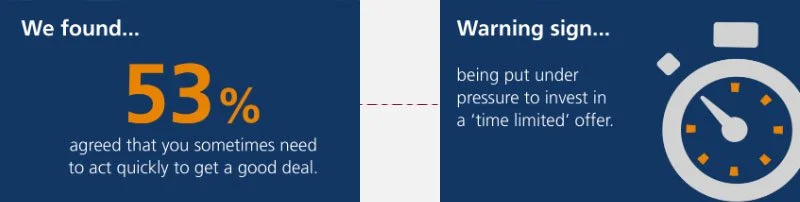

Pressure and limited time offers are other ways to confuse and distract you into signing up for a scam. Take your time always!

Limited Time Offers

Guaranteed Returns

Random Cold Outreach

Claims of being able to offer you a guaranteed portfolio rate of return or any return that seems to good to be true.

Calls from Investment or Financial Advisers that you weren’t expecting, or even engagement on social media.

Some scammers will claim to be able to get you your money earlier or provide you with more than 25% tax free cash. Beware!

Free Pension Reviews

Although perhaps a genuine outreach, many scammers have used free pension reviews as a tool to start this process.

Offering Early Access

4 Steps you can deploy to protect yourself from scammers

Reject Unexpected Offers

Unless you have sought help from somewhere credible and are expecting a call, you should be very wary if you’re contacted out of the blue about your pension, chances are high that it’s a scam.

Always be wary of anyone offering a free pension review. A free offer out of the blue from a company you have

not dealt with before is probably a scam. Genuine Financial Advisers may offer free reviews too but more often than not, it is the start of the scam journey for many. Fortunately, research shows that 95% of unexpected

pension offers are rejected by customers, which is great news.

Double check who you are dealing with

If you don’t use an FCA-authorised firm, you also won’t have access to the Financial Ombudsman Service or the Financial Services Compensation Scheme. So you’re unlikely to get your money back if things go wrong.

If the firm is on the FCA Register, you should call the Consumer Helpline on 0800 111 6768 to check the firm is permitted to give pension advice. Beware of fraudsters pretending to be from a firm authorised by the FCA, as it could be what we call a ‘clone firm’. Use contact details provided on the FCA Register, not the details they give you.

If they are a firm that works outside of the UK, then please make sure they are regulated in your jurisdiction (Eg. if you live in the USA, then you should be seeking advice from a US firm) and ask to see proof of this along with any qualifications they may hold to prove they have been educated to a satisfactory level to provide investment or financial advice.

Unfortunately not all FCA regulated firms can give advice to Expats and 80% of the problems relating to fraud, scams and mis-selling, stem from the international space.

Don’t ever feel rushed or pressured into any decision

Creating a sense of urgency for an amazing deal psychologically makes people drop their guard to rational thought. Always take a step back and look at what is being presented and how it has been presented. Most people calling you; who you have never spoken with before, who have an amazing plan or idea which has a time sensitive offer, will most likely be pushing their own agenda.

The team at Invinitive have been advisers in the industry for quite some time prior to setting up our Pension product and we have taken on / inherited many clients over the years that had been scammed by an unscrupulous/unregulated adviser. Some had lost almost everything. It’s YOUR MONEY, do not ever feel pressured into doing something that is out of your knowledge or comfort zone.

When in doubt go to step 4 every time!

Get FREE and impartial advice from MoneyHelper

MoneyHelper (www.moneyhelper.org.uk)

Provides free independent and impartial information and guidance.

Pension Wise

This is a service from MoneyHelper, backed by government (www.moneyhelper.org.uk/en/pensions-andretirement/ pension-wise) If you’re over 50 and have a defined contribution (DC) pension, Pension Wise offers pre-booked appointments to talk through your retirement options.

Financial advisers

It’s important you make the best decision for your own personal circumstances, so you should seriously consider using the services of a financial adviser. If you do opt for an adviser, be sure to use one that is regulated by the FCA or your local regulatory body and never take investment advice from the company that contacted you or an adviser they suggest, as they may be part of the scam.